I. Definition

Corporate Internet Banking is the corporate electronic financial accounting management system developed by ICBC. Through Internet Banking, the insurance company HQ may exercise financial control over the subsidiaries. It renders real-time inquiries over the branch companies' account balance, batch fund collection, batch fund payment, and outward account payment. It supremely saves manpower and physical resources under secure environment.

II. Product Introduction

The ICBC Internet Banking provides insurance companies with service supports including: account management, information report, on-line settlement, B2B and B2C online payment, VIP room (automated fund collection, wage payment through agency, expense reimbursement through agency), group financial planning, online fee collection, online agency payment and settlement, bank and corporation connection, and online insurance.

III. Target Client

It is suitable for insurance companies with wide coverage of business network and high requirement for informationalized management.

IV. Service Procedure

The insurance company establishes the special agreement with ICBC; ICBC assists the insurance company in installing the Internet Banking system and configures the relevant responsibilities and authorities for Internet Banking operation; the insurance company realizes convenient and prompt services and functions through Corporate Internet Banking.

V. Solutions

(I) Internet Insurance

ICBC is able to launch Internet Banking cooperation with the insurance companies catering for services like company advertisement, product advertisement, online insurance application, and insurance policy information enquiries.

Service Procedure: The insurance company signs partnership agreement with ICBC HQ to develop online insurance products. The insurance company and the local branch of ICBC jointly organize testing, launch, and authentication.

(II) Special Websites Cooperation

The insurance companies participate in ICBC special websites and become the special seller in ICBC "online shop". Upon policy application, the customer only needs one ICBC consumer Peony Quasi Credit Card, Peony Credit Card, Peony Business Card, Peony Money Link Card, or Comprehensive Account Card and opens the online payment function, then the customer is able to select type of insurance on the insurer's website, input the insurance policy information, and select payment through ICBC. When the customer selects online payment through ICBC, it is linked to the ICBC payment webpage. The customer inputs the payment card number and the password, confirms the information, and completes the online policy purchase. This product has the advantages in comprehensive functions, real-time and highly efficient processing, large customer base, and flexible means of payment.

Service open procedures: the customer may apply for service open at ICBC in their locality. The customer signs Online Payment Agreement and conducts business testing before the service open.

(III) Agency Collection of Insurance Premium

Agency Collection of Insurance Premium is a classic service extended to insurance companies. The insurance companies actively collects the due premiums and fees from the authorized/contracted customers ("Paying Customer" hereinafter) through ICBC Internet Banking.

The collection service enables two functions including batched deduction from enterprises and batched deduction from individuals according to the different Paying Customers. The insurance companies give deduction instructions at any time through Internet Banking. The Intra-City transactions are executed within 24 hours through computer networks and the accounts are booked on real-time basis. The Inter-city transactions are done within fund transfer time limit and the instruction for express service is processed on real-time basis and the accounts are booked on real-time basis. The regular instructions are processed on real-time basis and the accounts are booked on batch basis. For villages and sub-towns under the county level where there is no presence of ICBC, the deduction can be realized through ICBC Internet Banking correspondent institution - rural credit cooperatives accounts. The service herein includes two methods - batched deduction from enterprises (i.e. a service where the insurance companies actively collect the due authorized premiums and fees through ICBC Internet Banking) and batched deduction from individuals (i.e. the Paying Customers are in mode of individual fee and premium collection, apart from the function of batched deduction from enterprises, it has additional function of "Enquiry for Paying Customer Name List").

Product feature and strength: it takes full advantage of ICBC network resources and network strength to enable collection nationwide and to realize fee collection across regions. It provides insurance companies with prompt and safe fund pooling mechanism and effectively accelerates the speed of fund collection and shortens the collection cycle for insurance companies. It can quickly convert account receivables into the liquidity fund in the books and effectively enhances the fund utilization among insurance companies, thereby achieving the automated settlement. Through Internet-based collection service, the system can assist the insurance companies to save printing large volumes of "Inter-City Designated Consignment Collection" vouchers, dramatically reduces the work load of insurance companies and effectively prevents from the operation risks, thereby achieving paper-less operation. Through collection service, the insurance companies collect the due fees and premiums from the Paying Customers as per pre-defined collection cycle and move into the phase of true online collection. This significantly increases the independence of fund operation, thoroughly enhances the financial management level, optimizes the insurance company business flow, and realizes highly efficient management. For Bill-Payment Customers, they only need to sign an agreement and provide a payment account number, and as long as there is sufficient fund in the payment account, the Paying Customers will no longer have to waste time and efforts in paying fees, thereby increasing the convenience in fee payments. The service also enables online signing of agreement.

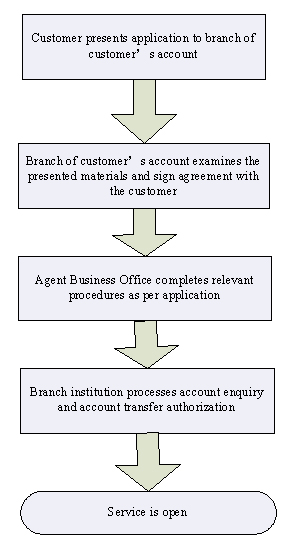

Service opening procedures: the insurance companies open the batched deduction from enterprises and batch deduction from individuals functions and become the ICBC Internet Banking customer. The procedure of application and opening of the batched deduction from enterprises and batch deduction from individuals is as per the following flowchart:

(IV) Internal Financial Management

The service includes three components: Account Management, Outward Payment, and Group Financial Planning that are described below for details:

1. Account Management

The Account Management refers to service where the insurance companies conduct account enquiry, download, printing, and other account services through ICBC Internet Banking. It includes online enquiry and download for the functional and foreign currency account balance for the group HQ and the branch institutions in each locality, the current daily account breakdowns and historical account breakdowns. It also enables online enquiry and printing the electronic reply slip.

Service opening procedures: The customer only needs to apply to become the Internet Banking Enterprise Customer (incl. group customer and regular customer) to enjoy "Account Management" services. No additional fees is charged for this service.

2. Outward Payment

The service enables all outward payments such as Bill Payment, Wage Payment, and Claim Payment. The services including Online Remittance, Corporate Financial Office, and the Directional Payment that will be given more elaborations herein.

(1) Online Remittance

The insurance companies may pay out its fund from the account through electronic payment instruction to complete fund settlement with other entities (with accounts in any banks in China) intra-city or inter-city, thereby achieving easier enterprise daily routine settlement at office instead of going to bank.

Service opening procedures: The insurance companies only needs to apply to become the Internet Banking Enterprise Customer (incl. group customer and regular customer) and enjoy "Online Remittance" services without incurring any additional charges.

(2) Corporate Financial Office

Corporate Financial Office service is a channel through which ICBC Corporate Internet Banking provides insurance companies with speedy wage payment and expense reimbursement. It also features electronic payroll upload function. The employees authorized for ICBC Personal Internet Banking may enquire the electronic payroll online. The insurance companies may make batch commission payment to agents in the nation through such function. The Internet Banking Enterprise Customers may open the Corporate Financial Office by itself through interface of "Add Payment Account". The system also enables the self-help payment account cancellation, batched placement of payment instruction, batched approval (for instruction authorization), instruction enquiries, and other functions.

The insurance companies may produce electronic payroll as per relevant ICBC format and send the payroll to ICBC through Corporate Internet Banking "Customer Service" - "Electronic Payroll Upload". The employees who opened ICBC "Banking@home" Personal Internet Banking may directly logon Personal Internet Banking interface to enquire his/her electronic payroll.

Service opening procedures: The insurance companies may open the Corporate Financial Office by itself through Corporate Internet Banking or file for relevant opening procedures at the Business Office with its bank account. To independently open the Corporate Financial Office function through Corporate Internet Banking, the insurance companies only needs to logon Corporate Internet Banking, select "Payments" - "Corporate Financial Office", click "Add Payment Account", and select corresponding payment account and account number to complete the process.

(3) Directed Remittance

The Directed Remittance is service through which ICBC provides insurance companies with direct payment to designated receiving account through Internet Banking. It is applicable for insurance companies with fairly regular transactions or insurance companies that need to control the fund flow for some accounts.

Utilizing Directed Remittance service, the insurance companies and the group insurance companies and their branch institutions may configure one or multiple accounts of the company to pay to only designated receiving accounts (can be one or multiple receiving accounts) when allocating fund through Internet Banking. In which, the designated receiving account can be the internal account in the group company, the common account outside the companies, the ICBC account, or non-ICBC account. When using Directed Remittance, the companies are able to exercise effective control over the fund flow direction of the company accounts, ensure the purpose of fund in the accounts. Such service substantially assists the companies to strengthen financial control and to enhance financial management.

Service opening procedures: The customers intending for Directed Remittance needs to apply for service opening. The customers already registered for Corporate Internet Banking may simultaneously apply for Directed Remittance services. The customers shall fill in ICBC Internet Banking Electronic Banking Enterprise Customer Registration Application while completing the opening procedures as per "Opening Procedures for Account Management".

The customer shall fill in Directed Remittance Information Sheet. The Business Office with the customer's account examines the content and passes the sheet to the agent Business Offices for relevant key entry and registration procedures. The insurance companies already subscribed to Internet Banking shall apply for Directional Remittance service. It shall fill out and submit the ICBC Internet Banking Corporate Customer Change (Cancellation) Application and Directed Remittance Information Sheet. The Business Office with the customer's account examines the content and passes the sheet to the agent Business Offices for relevant key entry and registration procedures before the service is open.

For insurance companies who have applied for Directional Remittance function upon corporate registration, the teller of the Business Office with the customer's account shall examine the Directed Remittance Information Sheet filed by the customer; upon registration information key entries, the agent Business Offices shall set the payment account number for Directional Remittance under column of "Insurance Company Management - Revise Approved ID"; in the column of "Set ID Directional Remittance A/C Number", the user may select the operable ID in sequence and select the Directional Remittance payment account numbers and the corresponding receiving account numbers.

3. Group Financial Planning

Group Financial Planning is a service through which ICBC provides intra-group-companies fund pooling, fund allocation, and transfers to the group company customers through benefit of Internet Banking. It is applicable to the group (systematic) companies or group (systematic) insurance companies that open deposit accounts at ICBC for the group HQ and branches/subsidiaries.

Service opening procedures: the group customer may use the Group Financial Planning function upon registration for Corporate Internet Banking.

Flowchart of Group Financial Planning service opening for insurance companies: